Electronics Tariff Exemption: Tech Titans Dodge Trump’s Latest Trade Barrage

A sudden turn, chaos in the air, and just like that, the landscape for US-bound electronics has shifted. Late Friday, a Customs and Border Protection notice dropped—electronics imported to the United States are now shielded from President Trump’s latest reciprocal tariffs. Smartphones, monitors, electronic guts, the lifeblood of America’s tech obsession, all spared. But not everything. Not even close. The president’s 145% tariffs on Chinese goods still hit plenty hard, but not here. What this signals: a direct lifeline to Apple, Nvidia, Microsoft, and the rest, right when they needed it most. Investors rejoiced. Shoppers? Breathing easier. For now.

Big Tech’s Sigh of Relief Echoes Across Wall Street

Relief? That doesn’t even cover it. Wedbush Securities, the folks tracking every Apple move, called this exemption “the best news possible for tech investors.” As if Apple, Nvidia, and Microsoft weren’t already riding high, now they’re untouchable, at least for the moment. Analysts insist this is the shot in the arm the sector needed, with negotiations over the broader China tariff war still looming like a storm on the horizon. The inescapable conclusion is that tech stocks just dodged a bullet. The industry can keep humming, devices can keep flowing—at least until the next policy swerve.

Production Lines Stay Put—For Now

Apple’s got a problem most companies would envy: nearly 90% of its iPhones are built in China. Moving that? Herculean. The White House keeps hammering the “ onshore production” drum, but reality says it won’t happen overnight. Sure, President Trump brags about massive new investments, citing Apple and chipmakers like TSMC and Nvidia, all supposedly racing to build in the US. In truth, the factories aren’t sprouting up at the snap of a finger. The big names may talk, but supply chains—especially for semiconductors and smartphones—are stuck overseas for now. The result: the tariff exemption keeps the status quo humming.

Tariffs and Consumer Angst—A Tangled Web

Fear spreads fast when tariffs threaten. Americans, always alert to price hikes, rushed to snag electronics and cars before sticker shock could set in. No surprise, really. Economists keep warning that tariffs mean higher costs for shoppers, and the panic buying proves the point. Nintendo’s Switch 2, caught in the crosshairs, saw its preorder date punted as the company pondered tariffs and swirling market jitters. Price tags could balloon—from 600, some say. The message? Uncertainty reigns, and everyone’s bracing for the next shoe to drop.

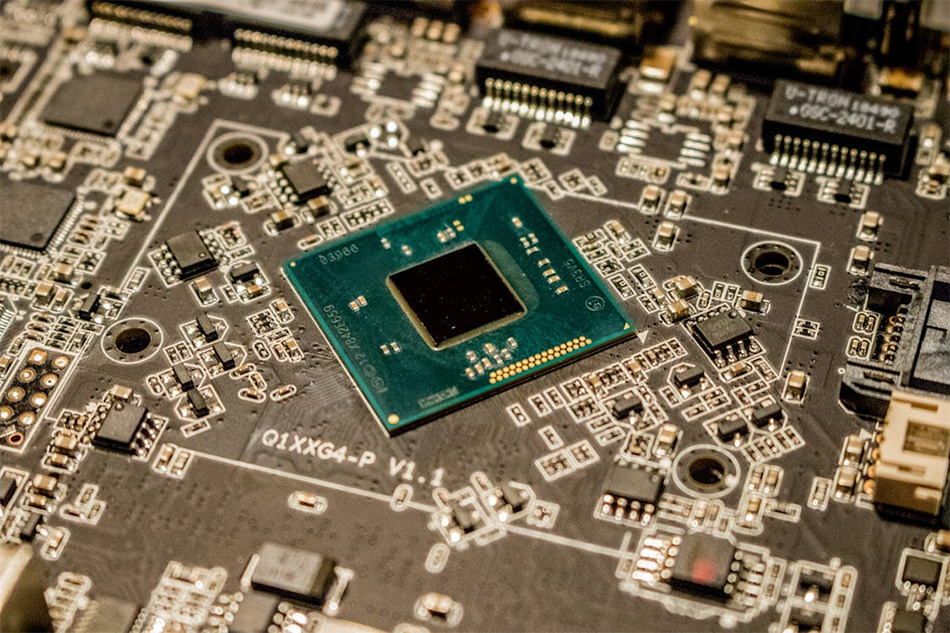

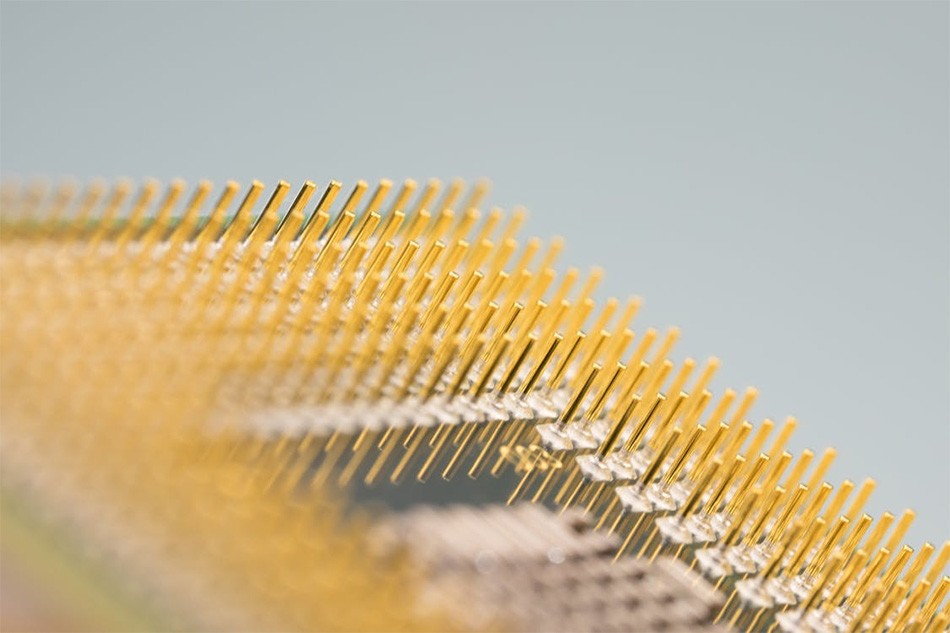

Winners and Losers in the Chip Wars

Not every product gets a golden ticket. Semiconductors and microchips, critical but mostly made in Asia, now enjoy a reprieve. Taiwan’s TSMC, South Korea’s Samsung, SK Hynix—they’re all breathing easier too. Yet the broader tariffs hit other sectors: autos, steel, pharmaceuticals. The administration promises fairness, but the exclusions feel surgical, not sweeping. Some items simply can’t be sourced domestically, no matter how loudly politicians demand it. The global supply chain remains tangled, so exemptions for chips and electronics might help some players while leaving others out in the cold.

Uncertainty Remains the Only Constant

The headlines scream relief, but the undercurrent is unmistakable. This exemption buys time, not victory. Tech giants and the investors riding their waves celebrate, yet the broader trade war remains unresolved. The administration’s ambition to yank manufacturing back to American soil collides with stubborn market realities and decades of offshoring. It’s a game of chess, not checkers, and each move only heightens the tension. The only certainty? More twists ahead. Consumers, companies, and policymakers are left watching, waiting, and bracing for whatever comes next. No one’s exhaling just yet.