Rising RAM Costs: Why Everyday Tech Could Get More Expensive in 2026

Prices rarely jump for just one gadget. When memory costs surge, the whole digital stack feels it. Phones, laptops, smart TVs, even medical devices, all lean on RAM, and RAM now sits at the center of a price storm. Since October 2025, memory that once looked cheap and boring has more than doubled in cost, with some buyers now quoted several times what they paid only months ago. The inescapable conclusion is simple: 2026 won’t just test chip makers, it will test household tech budgets as well.

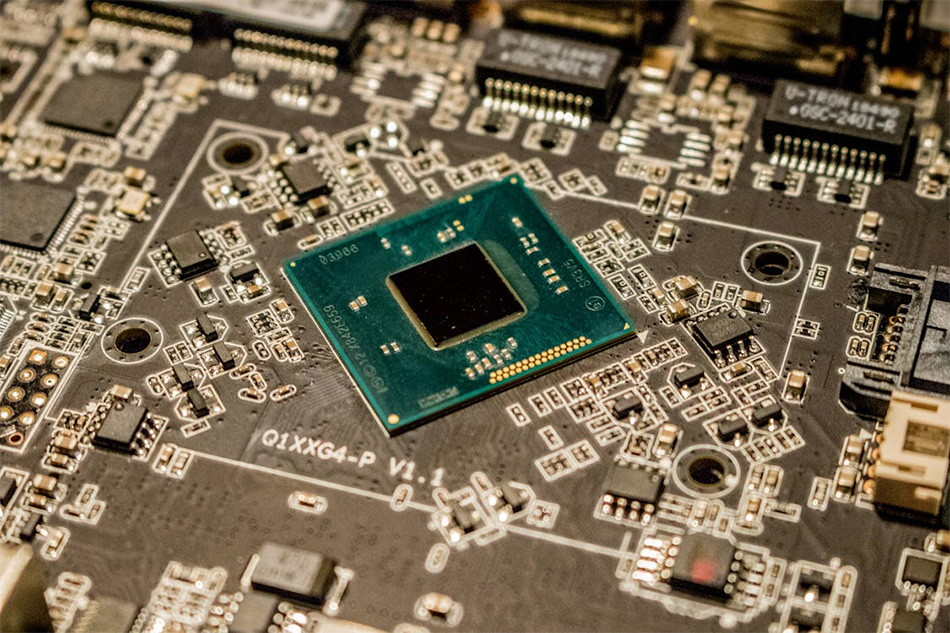

RAM Turns From Commodity to Cost Driver

For years, RAM behaved like background noise in a bill of materials. Essential, yes, but cheap enough that manufacturers barely flinched. That era just ended. Computer builders now report quotes as high as 500% above recent levels. When a component that sits in every PC, tablet, and console starts multiplying in price, something has to give. Margins don’t stretch forever. Memory typically represents 15–20% of a PC’s cost, yet current pricing pushes that share toward 30–40%. At that point, RAM doesn’t just support the system, it dictates the price tag, and producers can’t pretend otherwise.

AI Data Centers Soak Up Memory Supply

Blame doesn’t sit with laptops or phones. The real vacuum lives in AI data centers. High-end AI systems feast on High Bandwidth Memory and vast pools of regular RAM, and hyperscale cloud providers now lock in their needs for 2026 and 2027. That advance planning gives memory makers a crystal-clear demand signal: supply will fall short of what giants like Amazon and Google want. Once that clicks, suppliers stop acting cautiously. Some have even paused issuing new price quotes, a rare and bold move that screams confidence in even higher prices ahead across many memory types.

Winners, Losers, and the Inventory Game

Not every memory vendor sits in the same boat. Some built stock early, then walked into this surge with fuller warehouses and gentler price moves, maybe 1.5x to 2x. Others misjudged the curve, hold thin inventory, and now push prices up to five times higher. System builders sit in the crossfire, trying to choose between pricier but stable partners and cheaper quotes that may not last. The imbalance creates a two-speed market: cautious planners gain a temporary edge, while late movers scramble. In the middle of that tension, the consumer quietly becomes the default shock absorber.

What It Means for Devices and Demand in 2026

Manufacturers traditionally swallow small cost bumps to stay competitive, but this spike isn’t small. Once memory climbs toward forty percent of system cost, many brands face an ugly choice: raise prices, cut features, or ship fewer units. Market watchers already expect higher device prices to bleed into 2026 and possibly cool demand. If memory prices don’t ease, buyers may delay upgrades, stretch old hardware longer, or trade down to cheaper models. That shift ripples back up the chain, forcing vendors to rethink product mixes, promotions, and even how many configurations they dare to launch.

The pattern lines up cleanly. AI data centers soak up memory, suppliers see tight supply, prices jump, and everyday devices inherit the bill. Some firms with smart inventory moves will soften the blow, but they sit as exceptions, not the rule. As RAM costs climb and margins thin, device makers lose room to shield shoppers. The bottom line for 2026 looks clear: expect more expensive PCs, phones, and smart devices, slower upgrade cycles, and a tech market that suddenly remembers memory isn’t a footnote, it’s a strategic risk.