Pay Attention: Six Important Things You Must Know about Apple Pay

Apple officially announced their mobile payment and digital wallet service, Apple Pay, along with the unveiling of the latest versions of the iPhone. Apple Pay is not really anything unexpected. It already figured in last year’s rumors. However, this new Apple service is not just any digital wallet service. There are aspects of it users need to properly know and understand.

Apple Pay – An Overview

Scheduled for launching (official deployment) in the United States next month, Apple Pay is the iPhone maker’s attempt in creating a new service in the world of finance, capitalizing on the popularity of Apple’s products, the iPhone in particular. It is a mobile payment system and digital wallet service that works with Apple devices starting from the iPhone 5. It allows shoppers to pay at retail store and online checkouts using their (compatible) iOS devices.

Essentially, with Apple Pay, Apple is trying to digitize and eventually supplant the use of magnetic strip cards at credit card terminals. It is a system that enables the wireless communication between an iOS device and a point of sale system.

1. Compatible Devices

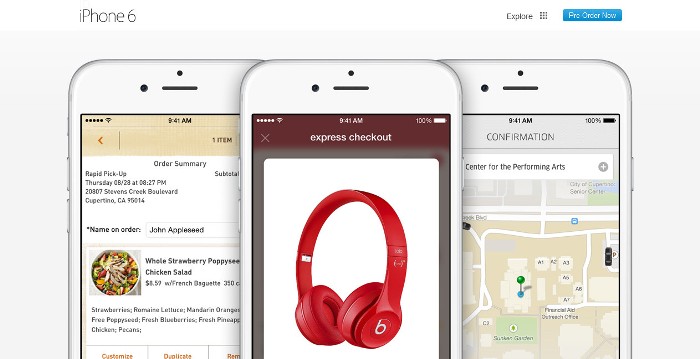

The iPhone 6 and iPhone 6 Plus will be the first devices that will be able to directly or natively support Apple Pay. Only the more recent iPhones are capable of natively supporting the service because these are so far the only iOS devices that come with NFC. Older iOS devices will eventually be able to support the service as the Apple Watch becomes available to buyers. The Apple Watch has NFC support so it can serve as the bridge between the POS or credit card terminal and the iOS device without NFC.

2. How It Works

Unfortunately, Apple Pay cannot immediately become a viable payment system for all iPhone 6 and iPhone 6 Plus owners. This is because it requires NFC connectivity and not every store has an NFC capable payment terminal. Hence, not every store that accepts card payments can accommodate Apple Pay payers. The basic elements that should be present for this payment facility to work are as follows: an NFC supporting payment terminal and an iPhone with NFC or an iOS device linked to the Apple Watch.

Transaction approvals (by the buyer, iOS device holder) with the iPhone 6 and iPhone 6 Plus will be done by positioning the finger on the Touch ID or fingerprint sensor. On the Apple Watch, transaction approval is through the tapping of a button next to the Digital Crown. The iPhones and Apple Watch should provide a tactile feedback to confirm the payment.

Of course, Apple is not a bank or financial system so you can’t expect an iPhone to have a digital currency that will be honored by stores. Hence, a credit or debit card will have to be signed up with the iOS device. To do this, you will have to take a photo of your credit or debit card. Just follow the instructions on the app and you should be good to go. Credit cards will be associated with your iTunes account.

3. Advantages of Apple Pay

One of the major advantages of Apple Pay is customer privacy. With it, customer payment information will no longer be divulged to the retailer. Buyers will remain anonymous. The system simply creates a dynamic security code is created for every transaction. This means that you will not have to present your cards. This means significantly reduced instances of lost and damaged cards.

Apple also says that it will not use Apple’s online service to process payments. The (allegedly) recently breached iCloud system will not be used for the Apple Pay service. Transaction details will not be stored in any of Apple’s web servers.

Another advantage of Apple Pay is said the be the lower transaction fees. Although this is yet to be confirmed, Apple Pay will reportedly have lower mobile charges compared to PayPal.

It is also worth noting that the sophisticated system involved in Apple Pay, tends to make it a safer system. In Apple Pay, transactions are verified wirelessly and with the buyer’s fingerprint (for iPhone 6 and 6 Plus users). This setup prevents any card cloning, signature forging, and other standard fraudulent transctions to take place. So far, there is no known scanner that can skim details out of transactions consummated with Secure Element chips like the ones to be used by Apple Pay.

4. Is It Secure?

As mentioned in the advantages above, Apple tries to keep the system highly secure by ensuring anonymity when making payments and avoiding the use of Apple’s own online system to prevent problems (at least) on Apple’s part. Apple Pay transactions are very new and sophisticated so it will likely take years before someone comes up with a method and the right equipment to defeat the security system Apple Pay is using. The fingerprint scanning in transactions, moreover, means that if persons with felonious intentions attempt to steal from you through your Apple device, they will have to do something similar to what spies and agents in action and thriller movies are doing. They need to have your device and obtain your fingerprint.

5. Which Stores Will Accept Apple Pay?

The official Apple Pay page mentions that more than 220,000 stores will accept Apple Pay. These include Babies R Us, Disney Store, Bloomingdales, Duane Reade, Macy’s, McDonalds, Nike, Petco, Staples, Subway, Toys R Us, Unleashed, Walt Disney Parks and Resorts, Walgreens, and Whole Foods Market. Of course, you don’t have to memorize all of these stores. Just look for the icon pictured below in a store. Better yet, you can ask the store if they accommodate Apple Pay.

For online app-based purchases, the following will be able to accept Apple Pay transactions: Groupon, Instacart, MLB.com, OpenTable, Sephora, Panera Bread, Starbucks, Target, Tickets.com, and Uber. You can use the apps of these companies to pay with Apple Pay.

6. Which Cards Work with Apple Pay?

As of the most recent announcement, Apple Pay will work with Visa, MasterCard, and American Express cards. Take note, however, that, this applies to the United States banks only (for now). Hence, only cards issued by American banks like Bank of America, American Express, Chase Capital One, Citi and Wells Fargo will be accepted. PNC, USAA, US Bank, Barclaycard, and Navy Federal are expected to adopt Apple Pay later on.

Apple Pay is a good step towards digitizing the payment system. However, it is not necessarily the best method in achieving a truly convenient digital and smartphone-based payment system. What’s ideal is to establish a standard that works with all kinds of smartphones and supported by the banking or financial services industry. Nevertheless, if Apple Pay becomes a success, it can be considered a good stride in pushing for a similar payment system not only for iOS devices but for other smartphones as well.