ASML Bets Big on Mistral AI: A Turning Point for Europe’s Tech Future

A bombshell deal. That’s what this is. Dutch semiconductor powerhouse ASML just threw €1.3 billion at French AI upstart Mistral AI, snapping up an 11% stake and instantly crowning itself the startup’s largest shareholder. Suddenly, Mistral sits atop the heap as Europe’s most valuable AI company. The number, €11.7 billion, doesn’t lie. Europe, so often an anxious spectator in the global tech arms race, now has two of its brightest stars teaming up. Some call it strategic vision. Others see desperation. Either way, the landscape just shifted.

Cash Isn’t the Story—Collaboration Is

Money grabs headlines, but the real news hides in the fine print. ASML and Mistral aren’t just trading shares and shaking hands; they’re locking themselves together for the long haul. The goal? Embed Mistral’s AI deep inside ASML’s chipmaking tools and operations. What this truly signals is a plan to make ASML’s lithography machines smarter, faster, and more adaptive—cutting precious weeks off chip development cycles. In the world of semiconductors, speed isn’t a luxury; it’s survival. Anyone who thinks this is a mere investment hasn’t been paying attention. The inescapable conclusion: this partnership is about control, not just cash.

Europe’s Tech Sovereignty: Words Become Action

For years, European officials have preached digital sovereignty, mouthing slogans about self-reliance while American and Chinese giants run the table. Suddenly, those speeches look less hollow. ASML, the crown jewel of European hardware, now stands shoulder to shoulder with Mistral, a homegrown AI contender. Is this enough to loosen Silicon Valley’s grip? That’s the burning question. Yet no one can deny the symbolism. The alliance isn’t just about products and patents; it’s Europe’s declaration that it won’t play permanent second fiddle. Whether that bravado translates into market share is another matter, but the intent is clear.

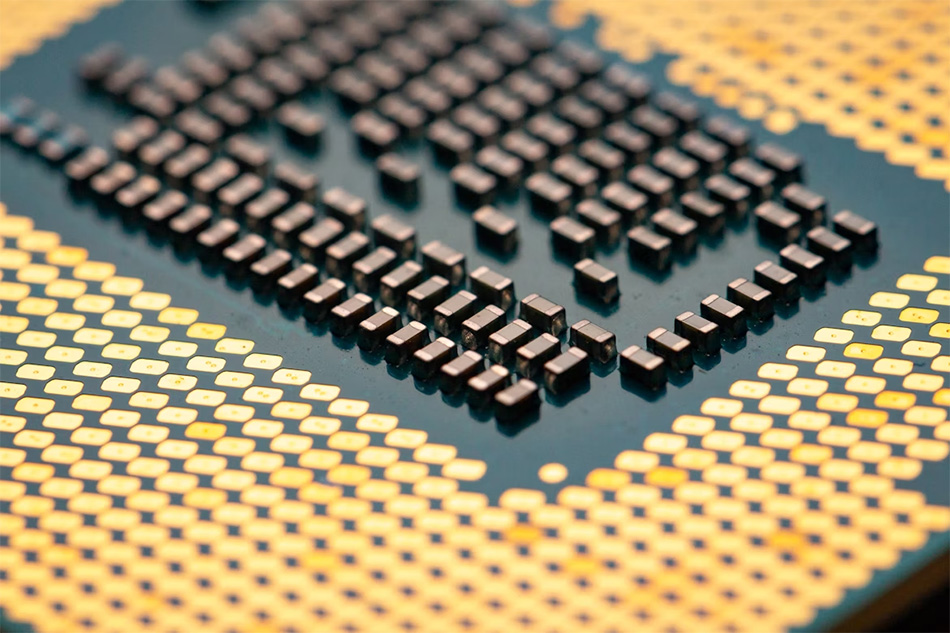

Chips Meet Code: The Rationale Behind the Gamble

ASML, famous for the hardware that powers the world’s chips, doesn’t typically court software startups. So why now? Analysts can’t stop drawing parallels to Microsoft’s leap into OpenAI—hardware and software fusing into something neither could achieve alone. By bringing Mistral’s AI into its workflow, ASML aims to push chip yields higher, catch problems before they snowball, and slash wasted effort in design. The bet is obvious: only by marrying cutting-edge AI with advanced manufacturing can Europe hope to keep up. Nobody’s pretending this is routine. The move screams ambition, and a little bit of fear.

Mistral: Underdog or Europe’s Great Hope?

Mistral AI, barely out of the starting blocks—it only sprang to life in 2023—now finds itself cast as Europe’s answer to OpenAI. Lofty? Absolutely. Its founders, veterans of Google DeepMind and Meta, are no strangers to big bets. Still, even with ASML’s billions, Mistral’s valuation remains pocket change compared to the likes of OpenAI or Anthropic. The risk is obvious: cash alone can’t conjure up a world-beating AI ecosystem overnight. Experts gush about the possibilities, sure, but warn that Europe’s leap may land short if the partnership stalls or rivals accelerate. Hope or hype? Time will tell.

Europe’s High-Stakes Tech Play Begins Now

The ink’s barely dry on this partnership, yet its impact already ripples through boardrooms and policy circles across the continent. ASML and Mistral aren’t just gambling on each other—they’re gambling on Europe itself. The message couldn’t be clearer: Europe refuses to watch from the sidelines as the US and China carve up the future of AI and semiconductors. Will this alliance close the gap or just mark another bold but doomed experiment? The stakes don’t get much higher. One thing stands out: Europe just raised its game, and the world is watching.