Why Aren’t We Using or When Will We Be Using Chip-Based Cards?

Chip-based credit cards are already several years old but why does it appear that the United States is still not using it to replace traditional credit cards? Why are most card issuers in the US stuck with the chip + signature and magnetic stripe swiping systems? This post will try to explore the reasons why a shift to chip-based + PIN cards makes sense, why it is not being widely adopted yet, and how can the shift become easier.

Advantages of Chip + PIN Cards

Chip-based cards offers a number of advantages to customers, mostly in terms of convenience, speed, and security. These advantages can be summarized as follows:

- Speedier payments – Combined with a PIN system, chip-based cards can enable faster service. This means faster processing of transactions that can lead to faster-moving queues. Chips also allow a contactless way of making payments.

- More payment options, unified card – Contactless payment is arguably the future and having it is definitely an advantage. Also, a chip can integrate different types of cards in one.

- Better security – Chip-based cards are more difficult to fake or clone. Since they can be used contact-free, syndicates that install their own readers on top of ATMs or kiosks will be rendered useless. They will have to come up with a way to circumvent the encryption and security protocols employed by banks and other financial companies – something they are unlikely to be capable of doing.

- Fewer transaction problems – Disputable and fraudulent payments can be minimized with the use of chip-based cards as they make use of a higher level of security. As mentioned earlier, they are difficult to counterfeit. Likewise, they are easier to monitor.

Disadvantage of Chip-Based + PIN Cards

Of course, the chip-based system also has its share of drawbacks. There is one major disadvantage that can be pointed out. This particularly applies (temporarily) to the United States setting. This disadvantage is the limited number of chip-based + PIN card issuers and readers. As what usually happens in a capitalistic world, operating cost minimization prevails especially when the most influential businesses decide to hold back the shift to a more advantageous technology to avoid upgrading costs. The limited number of chip + pin cards, naturally, means that there aren’t that many stores or establishments that have the readers to accommodate them.

Why the US Is Stuck with Chip + Signature and Swipe + Signature Systems

Practicality is one of the major reasons for the US being late to the chip + PIN party. For now, the magstripe cards and chip + signature systems remain in place for practicality reasons. Since not many businesses have decided to shift yet, there haven’t been that much compulsion for a change. Another reason is the shift in liability that comes with the shift to the chip + PIN system. For the longest time, banks and credit card companies have been held accountable for instances of fraud, the new VISA and MasterCard policies on chip + PIN system essentially shifts the liability to merchants and banks who fail to equip their stores. All these are in addition to the typical lack regulatory and logistical issues encountered by financial institutions that are not yet prepare to adopt the chip + PIN system.

When Will the Shift Happen?

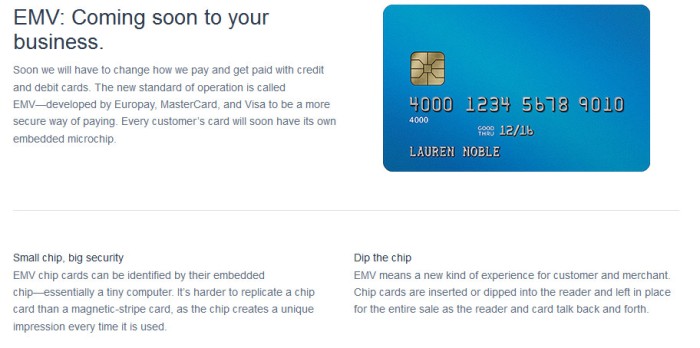

Fortunately, the shift will most likely become inevitable next year. Banks and merchants will already be required to accommodate chip-based Europay, MasterCard, and Visa transactions.

Square Solution

To make the shift easier, Square, a mobile payments company, announced that it has come up with a credit card reader capable of verifying purchases from a chip on the card. The system is called EMV (an acronym for Europay, MasterCard, and Visa). As cards are expected to have their respective embedded chips next year, a handy reader will most certainly be needed. Square’s solution is a welcome development.

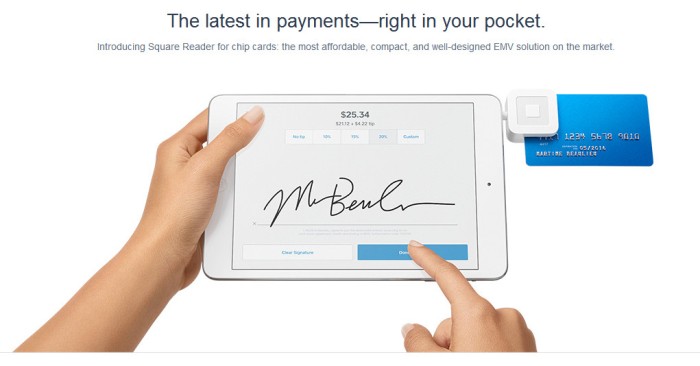

Square’s EMV is a small device that can connect to a smartphone or tablet via the 3.5mm audio jack. It is a pocket-sized solution that even addresses possible issues of compatibility or standards adoption since it can work with both chip and magnetic stripe based cards. It also comes with its own battery and can be charged through its USB port. Moreover, it is efficient in power consumption. It smartly detects when it is needed and automatically turns on when it needs to read a card.

For those who are worried about security risks, the Square EMV reader is claimed to have enhanced security using industry-leading security standards. The device’s developers promise constant monitoring for suspicious behavior and the use of advanced algorithms to detect and freeze suspicious activities.

The EMV reader is expected to become available for pre-order in the later part of the year. The company did not provide a specific release date. It is important to point out, however, that after October 2015, merchants in the US will be compelled to accept EMV transactions so older readers will be rendered useless. Obtaining a new card reader is hence a no-brainer. This isn’t a bitcoin-like scenario that is optional. The eventual shift will be a necessity for most merchants unless they want to limit their transactions to a cash basis. Fortunately, there haven’t been problems comparable to what happened with the “Pony” attack on bitcoin to discourage merchants from proceeding to the chip + PIN shift.